CALGARY, Alberta (AP) — President Donald Trump would have unique influence over the operations of U.S. Steel under the terms of what the White House calls an “investment” being made by Japan-based Nippon Steel in the iconic American steelmaker.

Administration officials over the past few days provided additional insight into the “golden share” arrangement that the federal government made as a condition for supporting the deal.

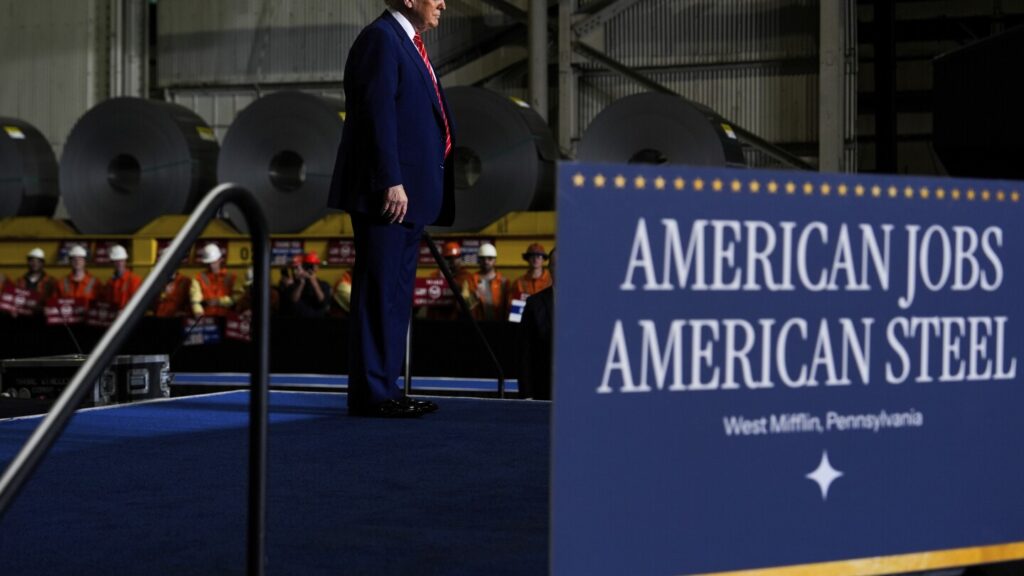

The Pittsburgh-based steel maker and Nippon Steel plan $11 billion in new investments by 2028 after indicating that they plan to move forward with the deal under the terms of a national security agreement that has the White House’s approval.

The White House has described the deal as a “partnership” and an “investment” by Nippon Steel in U.S. Steel, although Nippon Steel has never backed off its stated intention of buying and controlling U.S. Steel as a wholly owned subsidiary in a nearly $15 billion offer it originally made in late 2023.

Commerce Secretary Howard Lutnick posted on social media on Saturday how the “golden share” to be held by the president would operate, revealing that the White House is willing to insert itself aggressively into a private company’s affairs even as it has simultaneously pledged to strip away government regulations so businesses can expand.

Under the government’s terms, it would be impossible without Trump’s consent to relocate U.S. Steel’s headquarters from Pittsburgh, change the name of the company, “transfer production or jobs outside the United States,” shutter factories, or reincorporate the business overseas, among other powers held by the president.

Lutnick also said it would require presidential approval to reduce or delay $14 billion in planned investments.

“The Golden Share held by the United States in U.S. Steel has powerful terms that directly benefit and protect America, Pennsylvania, the great steelworkers of U.S. Steel, and U.S. manufacturers that will have massively expanded access to domestically produced steel,” Lutnick posted on X.

That $14 billion figure is higher than what the companies disclosed on Friday when Trump created a pathway for the investment with an executive order based on the terms of the national security agreement being accepted.

Lawmakers from Pennsylvania say the higher figure includes the cost of an electric arc furnace — a more modern steel mill that melts down scrap — that Nippon Steel wants to build in the U.S., bringing the value of the deal to at least $28 billion.

The president has the authority to name one of the corporate board’s independent three directors and veto power over the other two choices, according to a person familiar with the terms of the agreement who insisted on anonymity to discuss them. The details of the board structure were first reported by The New York Times.

Details of the agreement emerged as Trump was traveling to Alberta in Canada for the Group of Seven summit.

Still, the full terms remain somewhat unclear. The companies have not made public the full terms of Nippon Steel’s acquisition of U.S. Steel or the national security agreement with the federal government.

On Sunday, the United Steelworkers, the labor union representing U.S. Steel employees, posted a letter raising questions about the deal forged by Trump, who during his run for the presidency had pledged to block Nippon Steel’s acquisition of U.S. Steel.

The union said it was “disappointed” that Trump “has reversed course” and raised basic questions about the ownership structure of U.S. Steel.

“Neither the government nor the companies have publicly identified what all the terms of the proposed transaction are,” the letter said. “Our labor agreement expires next year, on September 1, 2026, and the USW and its members are prepared to engage the new owners” of U.S. Steel “to obtain a fair contract.”

If Trump has as much control of U.S. Steel as he has claimed, that could put him in the delicate position of negotiating the salary and benefits of unionized steelworkers going into midterm elections.

As president, Joe Biden used his authority to block Nippon Steel’s acquisition of U.S. Steel on his way out of the White House after a review by the Committee on Foreign Investment in the United States.

After he was elected, Trump expressed openness to working out an arrangement and ordered another review by the committee. That’s when the idea of the “golden share” emerged as a way to resolve national security concerns and protect American interests in domestic steel production.

As it sought to win over American officials, Nippon Steel made a series of commitments.

It gradually increased the amount of money it was pledging to invest in U.S. Steel, promised to maintain U.S. Steel’s headquarters in Pittsburgh, put U.S. Steel under a board with a majority of American citizens and keep plants operating.

It also said it would protect the interests of U.S. Steel in trade matters and it wouldn’t import steel slabs that would compete with U.S. Steel’s blast furnaces in Pennsylvania and Indiana.

___

Levy reported from Harrisburg, Pennsylvania.