HONG KONG — The United States and China said Monday that they had agreed to a 90-day pause on most of the tariffs they have imposed on each other since last month, sending stocks soaring amid hopes of an easing trade war between the world’s two largest economies.

The combined U.S. tariffs rate on Chinese imports will be cut to 30% from 145%, while China’s levies on U.S. imports will be cut to 10% from 125%, the two countries said in a joint statement.

The early morning announcement came after officials from the two countries met in Geneva over the weekend. It was the first face-to-face talks on the tariffs since President Donald Trump’s shock “Liberation Day” announcement last month imposing 84% duties on Chinese imports, which subsequently climbed to 125% — and then to 145% a day later.

The new 30% rate is the sum of the 20% duty imposed imposed during the first weeks of his second term in response to alleged Chinese inaction on fentanyl flows, alongside the 10% across-the-board tariff Trump has imposed on all countries.

Markets surged on the news in early trading Monday as recession fears dissipated, with the S&P 500 climbing 2.6% and the Dow Jones Industrial Average adding more than 1,000 points or about 2.5%. The tech-focused Nasdaq jumped 3.5%.

Yet, some analysts offered a more tempered outlook, noting tariffs are still broadly higher compared with their levels before Trump took office. That suggests U.S. consumer goods will continue to see price increases.

“The full set of U.S. tariffs would still be considerably higher and broader than expected by markets at the start of the year,” Goldman Sachs analysts wrote in a note to clients Monday.

The analysts also noted that, for now, the China tariffs reduction is only slated to last 90 days — something that “should keep uncertainty high for both investors and businesses.”

The United States has a larger goods trade deficit with China than with any other country, and Trump has often accused it of “ripping off” the U.S. through unfair trade practices. Unlike other U.S. trading partners, Beijing responded by imposing retaliatory tariffs and other nontariff measures on Washington that quickly escalated in a dizzying game of one-upmanship.

U.S. officials had “very constructive and positive conversations with our Chinese counterparts, who clearly came to deal this week,” U.S. Trade Representative Jamieson Greer said at a news conference in Geneva.

The tariffs had amounted to “the equivalent of an embargo,” which neither side wanted, said Treasury Secretary Scott Bessent, who also represented the U.S. in the talks.

“We do want trade, we want more balanced trade, and I think that both sides are committed to achieving that,” he said.

Bessent rejected the suggestion that it might have been better to start with negotiations rather than announcing a series of tariffs that caused global financial turmoil, saying the U.S. had already tried to rebalance trade by working within the system and that “business as usual” would not have worked.

In an interview Monday morning on CNBC, Bessent said that the two countries now have “a mechanism to avoid the upward tariff pressure.”

The Chinese Commerce Ministry said the agreement was an “important step” and “creates favorable conditions for further narrowing differences and deepening cooperation.”

“It is hoped that the U.S. will build on the foundation of this meeting, continue to work in the same direction with China” and “completely correct its unilateral tariff practices,” a spokesperson said.

The afternoon announcement sent U.S. stocks leaping in premarket trading. The Dow Jones Industrial Average was up 2.1%, while the S&P 500 index was up 2.8% and the tech-heavy Nasdaq index was up 3.8%.

European indexes posted more modest gains late Monday morning, after Hong Kong’s Hang Seng Index soared following the news. The index closed up more than 3%, while mainland Chinese markets closed higher before details of the agreement were released.

Markets across Asia had upbeat sessions Monday in anticipation of some kind of agreement from the U.S.-China talks, as well as a ceasefire between India and Pakistan that seems to be holding despite localized skirmishes after conflict erupted between the two South Asian nations last week following a terrorist attack in Indian-administered Kashmir that killed 26 tourists.

The U.S. and China said they would also “establish a mechanism to continue discussions about economic and trade relations.” The U.S. will continue to be represented by Greer and Bessent, while China will continue to be represented by Vice Premier He Lifeng.

The discussions may take place alternately in China and the U.S., or in a third country agreed upon by both countries. The two sides may also conduct working-level consultations on relevant economic and trade issues.

Bessent said on CNBC that the two sides would likely meet again in the near future.

“I would imagine that in the next few weeks, we will be meeting again to get rolling on a more fulsome agreement,” he said.

Other U.S. tariffs on Chinese goods, including those from Trump’s first term, as well as more recent ones related to China’s role in the international flow of fentanyl, remain in place, with Greer saying that separate discussions on fentanyl were “on a very positive track.”

Bessent said on CNBC that he believed “the Chinese are now serious about assisting the U.S. and stopping the flow of precursor drugs.”

He emphasized in multiple interviews Monday morning that the U.S. did not want a general decoupling from China. Instead, the U.S. is “going to do a strategic decoupling, because we realized during Covid that efficient supply chains were not secure supply chains,” he said on MSNBC’s “Morning Joe.”

“So with steel, with semiconductors, with medicines, with a couple of other strategic categories, we are going to have to become self reliant again,” Bessent continued.

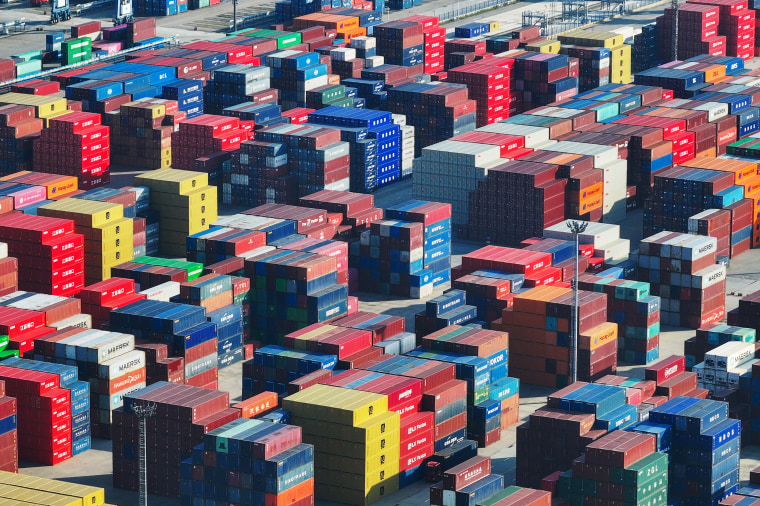

The impact of the reciprocal tariffs was already being felt, with the number of shipping containers traveling to the U.S. from China falling dramatically since early April.

Danish shipping giant A.P. Moller-Maersk called the U.S.-China tariff agreement “a step in the right direction.”

“We hope it can lay the foundation for the parties to also reach a permanent deal that can create the long-term predictability our customers need,” it said in a statement.

The agreement “will save medium and small enterprises on both sides of the Pacific,” said Tianchen Xu, a Beijing-based economist at the Economist Intelligence Unit, a financial forecasting service.

It will come as “a very big relief for struggling small Chinese exporters, some of which have already lost U.S. orders for weeks,” he said in emailed comments.

U.S. importers, meanwhile, “will be able to avoid a surge in import costs,” he said. “This carries positive implications for the overall economy and the labor market.”

The agreement exceeded expectations and has “rekindled global hope,” said Wang Wen, dean of the Chongyang Institute for Financial Studies at Renmin University of China.

But Xu and Wang both cautioned that many difficult issues remain to be resolved and the trade war could potentially reignite.

“This situation is a major test of the political wisdom and negotiation capability of the decision-makers in both China and the U.S.,” Wang said.

Ahead of U.S. and Chinese officials’ discussions in Geneva, Trump expressed willingness to slash tariffs on Chinese imports from 145% to 80%.

“80% Tariff on China seems right! Up to Scott B.,” the president wrote in a post Friday on Truth Social, referring to the treasury secretary.

A day earlier, Trump said in response to a reporter’s question about tariffs on Chinese imports that “it could be” that he would consider lowering them if the Geneva talks went well.

“You can’t get any higher. It’s at 145, so we know it’s coming down,” Trump said. “I think we’re going to have a very good relationship.”